Handbook for Employers M-274

Employers should check this online version of the handbook periodically for updates. Printing does not allow access to helpful links or updates to this handbook.

Guidance for Completing Form I-9 (Employment Eligibility Verification Form) | Current as of July 2023

1.0 Why Employers Must Verify Employment Authorization and Identity of New Employees

In 1986, Congress reformed U.S. immigration laws to preserve the tradition of legal immigration while seeking to close the door to unlawful entry. The employer sanctions provisions, found in section 274A of the Immigration and Nationality Act (INA), were added by the Immigration Reform and Control Act of 1986 (IRCA). These provisions further changed with the passage of the Immigration Act of 1990 and the Illegal Immigration Reform and Immigrant Responsibility Act (IIRIRA) of 1996.

Employment is often the magnet that attracts people to reside in the United States unlawfully. The purpose of the employer sanctions law is to remove this magnet by requiring employers to hire only individuals who may legally work here: U.S. citizens, noncitizen nationals, lawful permanent residents, and other noncitizens who are authorized to work. To comply with the law, employers must:

- Verify the identity and employment authorization of each person they hire;

- Complete and retain a Form I-9, Employment Eligibility Verification, for each employee; and

- Refrain from discriminating against individuals on the basis of national origin, citizenship or immigration status.

At the same time that it created employer sanctions, Congress also prohibited employment discrimination based on citizenship, immigration status, and national origin. This part of the law is referred to as the anti-discrimination provisions. See Section 11.0, Unlawful Discrimination and Penalties for Prohibited Practices, for more information on unlawful discrimination.

The guidance in this handbook, in tandem with the Form I-9 instructions, helps employers properly complete Form I-9, which assists in verifying that your employees are authorized to work in the United States. You must complete a Form I-9 for every new employee you hire after Nov. 6, 1986, as well as new employees hired in the Commonwealth of the Northern Mariana Islands (CNMI) on or after Nov. 28, 2009. This includes U.S. citizens and noncitizen nationals who are automatically eligible for employment in the United States.

You must use the current version of Form I-9, which you can download along with the instructions from the USCIS website at uscis.gov/i-9-central. You may also order paper forms at uscis.gov/forms/forms-by-mail or by calling the USCIS Contact Center at 800-375-5283 (TTY: 800-767-1833).

The form consists of five parts:

- Section 1: Employee Information and Attestation: Employees must complete and sign this section. See Section 3.0 of this handbook for more information.

- Section 2: Employer Review and Verification: Employers or their authorized representative(s) must complete this section. See Section 4.0 of this handbook for more information.

- Lists of Acceptable Documents: Employers must ensure every employee completing Form I-9 has access to this list. Employers are not required to store this page.

- Supplement A, Preparer and/or Translator Certification for Section 1: Any person who helps the employee complete Form I-9 must complete the blocks in this supplement. See Section 3.0 of this handbook for more information. If the employee does not require assistance, employers need not print this page.

- Supplement B, Reverification and Rehire (formerly Section 3): Employers or their authorized representative(s) complete the blocks of this supplement when an employee requires reverification, or is rehired and the employer chooses not to complete a new Form I-9. Employers only need to print this page for an employee when reverification or rehire applies. See Section 6.0 of this handbook for more information.

Form I-9 is available in English and Spanish. Employers in the United States, except Puerto Rico, must complete the English-language version of Form I-9. Only employers located in Puerto Rico may complete the Spanish-language version of Form I-9 instead of the English-language version. Any employer may use the Spanish-language form and instructions as a translation tool for Spanish-speaking employees, when completing the English-language version.

1.1 The Homeland Security Act

The Homeland Security Act of 2002 created an executive department combining numerous federal agencies with a mission dedicated to homeland security. On March 1, 2003, the authorities of the former Immigration and Naturalization Service (INS) were transferred to three new agencies in the U.S. Department of Homeland Security (DHS):

- U.S. Citizenship and Immigration Services (USCIS);

- U.S. Customs and Border Protection (CBP); and

- U.S. Immigration and Customs Enforcement (ICE).

The two DHS immigration components most involved with the matters discussed in this handbook are USCIS and ICE. USCIS issues most employment authorization documentation for noncitizens and administers Form I-9 and E-Verify, which electronically confirms employment eligibility. ICE enforces the penalty provisions of section 274A of the INA as well as other immigration requirements within the United States.

Under the Homeland Security Act, the U.S. Department of Justice (DOJ) retained certain responsibilities related to Form I-9 as well. In particular, the Immigrant and Employee Rights Section (IER) in the DOJ’s Civil Rights Division enforces the anti-discrimination provision in section 274B of the INA, while the Executive Office for Immigration Review (EOIR) administratively adjudicates cases under sections 274A, 274B, and 274C (civil document fraud) of the INA.

1.2 E-Verify: The Web-Based Verification Companion to Form I-9

Form I-9 has been the foundation of the employment eligibility verification process since 1986, when employers began verifying the employment authorization and identity of new hires under IRCA. To improve the accuracy and integrity of this process, USCIS operates an electronic employment eligibility confirmation system called E-Verify.

E-Verify is a web-based system that allows employers and other participants to confirm the eligibility of their newly hired employees to work in the U.S. by electronically matching information on the employee’s Form I-9 against records available to the Social Security Administration (SSA) and DHS. E-Verify is free and is available to participants in all 50 states, the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, and the Commonwealth of the Northern Mariana Islands.

Employers who participate in E-Verify must still complete a Form I-9 for each newly hired employee in the United States. E-Verify participants may accept any document or combination of documents from the Lists of Acceptable Documents on Form I-9, but if the employee chooses to present a List B and C combination, the List B (identity only) document must have a photograph. Employees must also provide their Social Security number in Section 1 of the Form I-9 if their employer is enrolled in E-Verify.

If you participate in E-Verify, after completing a Form I-9 for your new employee, you must create a case in E-Verify that includes information from Sections 1 and 2 of the employee’s Form I-9. After creating the case, you will receive a response from E-Verify regarding the employment authorization of the employee. In some cases, E-Verify will provide a response indicating a Tentative Nonconfirmation (mismatch). This does not necessarily mean the employee is unauthorized to work in the United States. Rather, it means that E-Verify is unable to immediately confirm the employee’s authorization to work in the United States. In the case of a mismatch, you must notify the employee. If the employee wishes to take action to resolve a mismatch, the employee should contact the appropriate agency (DHS and/or the SSA) within the prescribed time period stated in the Referral Date Confirmation that you will provide to the employee, and as described in the E-Verify User Manual.

When using E-Verify, participating employers must also follow certain procedures that were designed to protect employees from unfair employment actions:

- You must use E-Verify for all new hires, both U.S. citizens and noncitizens, and may not use the system selectively.

- You may not use E-Verify to prescreen applicants for employment, check employees hired before you became a participant in E-Verify (except contractors with a federal contract that requires use of E-Verify), or reverify employees who have temporary employment authorization.

- You may not terminate or take other adverse action against an employee based on a mismatch.

E-Verify strengthens the Form I-9 employment eligibility verification process that all employers, by law, must follow. By adding E-Verify to the existing Form I-9 process, participants can benefit from knowing that they have taken an additional step toward maintaining a legal workforce.

For more information about E-Verify, including enrollment, visit e-verify.gov or contact E-Verify at 888-464-4218.

Federal Contractors

On Nov. 14, 2008, the Civilian Agency Acquisition Council and the Defense Acquisition Regulations Council issued a final rule amending the Federal Acquisition Regulation (FAR) (FAR case 2007-013, Employment Eligibility Verification). The regulation requires contractors with a federal contract that contains the FAR E-Verify clause to use E-Verify for their new hires and all employees (existing and new) assigned to the contract (48 C.F.R., Subpart 22.18). Federal contracts issued on or after Sept. 8, 2009, as well as older contracts that have been modified may contain the FAR E-Verify clause.

Federal contractors who have a federal contract that contains the FAR E-Verify clause must follow special rules when completing and updating Form I-9. For more information, please see the E-Verify Supplemental Guide for Federal Contractors available at e-verify.gov.

Employers Who Use Alternative Procedures to Examine Form I-9 Documentation

The Department of Homeland Security issued a final rule, effective August 1, 2023, which allows the Secretary to authorize alternative procedures for examining the documents employees must present to complete Form I-9. On the same date through a Federal Register Notice, the Secretary made effective Optional Alternative 1 to the Physical Document Examination Associated with Employment Eligibility Verification (Form I-9). This alternative procedure allows employers who are enrolled in E-Verify and complete certain steps to remotely examine Form I-9 documents. For more information, please see Section 4.0: Completing Section 2 of Form I-9, I-9 Central and E-Verify.gov

2.0 Who Must Complete Form I-9

You must complete Form I-9 each time you hire any person to perform labor or services in the United States in return for wages or other remuneration. Remuneration is anything of value given in exchange for labor or services, including food and lodging. The requirement to complete Form I-9 applies to new employees hired in the United States after Nov. 6, 1986, as well as new employees hired in the Commonwealth of the Northern Mariana Islands (CNMI) on or after Nov. 28, 2009.

Ensure the employee receives the instructions electronically or in print and completes Section 1 of Form I-9 at the time of hire. “Hire” means the beginning of employment in exchange for wages or other remuneration. The time of hire is noted on the form as the first day of employment. Employees may complete Section 1 before the time of hire, but not before the employer extends the job offer and the employee accepts it. You may review the employee’s document(s) and fully complete Section 2 at any time from the date the employee accepts the job offer and completes Section 1 to within three business days from the date of hire. For example, if the employee begins employment on Monday, you must complete Section 2 by Thursday.

You may designate, hire, or contract with any person you choose to complete, update or make corrections to Section 2 or Supplement B, Reverification and Rehire, on your behalf, such as a member of the general public, personnel officers, foremen, agents, or notaries public. This person is known as your authorized representative. The authorized representative must perform all the employer duties described in the instructions and this handbook, and complete, sign and date Section 2 or Supplement B, Reverification and Rehire, on your behalf. You are liable for any violations in connection with the form or the verification process, including any violations committed by the authorized representative acting on your behalf.

USCIS does not require you to have a contract or other specific agreement with your authorized representative for Form I-9 purposes. If the employer chooses to use a notary public as an authorized representative, that person is not acting in the capacity of a notary. This person must perform the same required actions as an authorized representative, including signatures. When acting as an authorized representative, a notary public should not provide a notary seal on Form I-9.

Employees cannot act as authorized representatives for their own Form I-9. Therefore, employees cannot complete, update, or make corrections to Section 2 or Supplement B, Reverification and Rehire for themselves or attest to the authenticity of the documentation they present.

If an employee will work for less than three business days, Sections 1 and 2 must be fully completed at the time of hire (in other words, by the first day of employment).

Do not complete Form I-9 for employees who are:

- Hired on or before Nov. 6, 1986 (or on or before Nov. 27, 2009, in the CNMI), continuing in their employment, and have a reasonable expectation of employment at all times;

- Employed for casual domestic work in a private home on a sporadic, irregular, or intermittent basis;

- Independent contractors;

- Employed by a contractor providing contract services (such as employee leasing or temporary agencies) and are providing labor to you; or

- Not physically working on U.S. soil.

If you are self-employed, you do not need to complete Form I-9 on your own behalf unless you are an employee of a separate business entity, such as a corporation or partnership. In that case, you and any other employees must complete Form I-9.

Note: You cannot hire an individual who you know is not authorized to work in the United States.

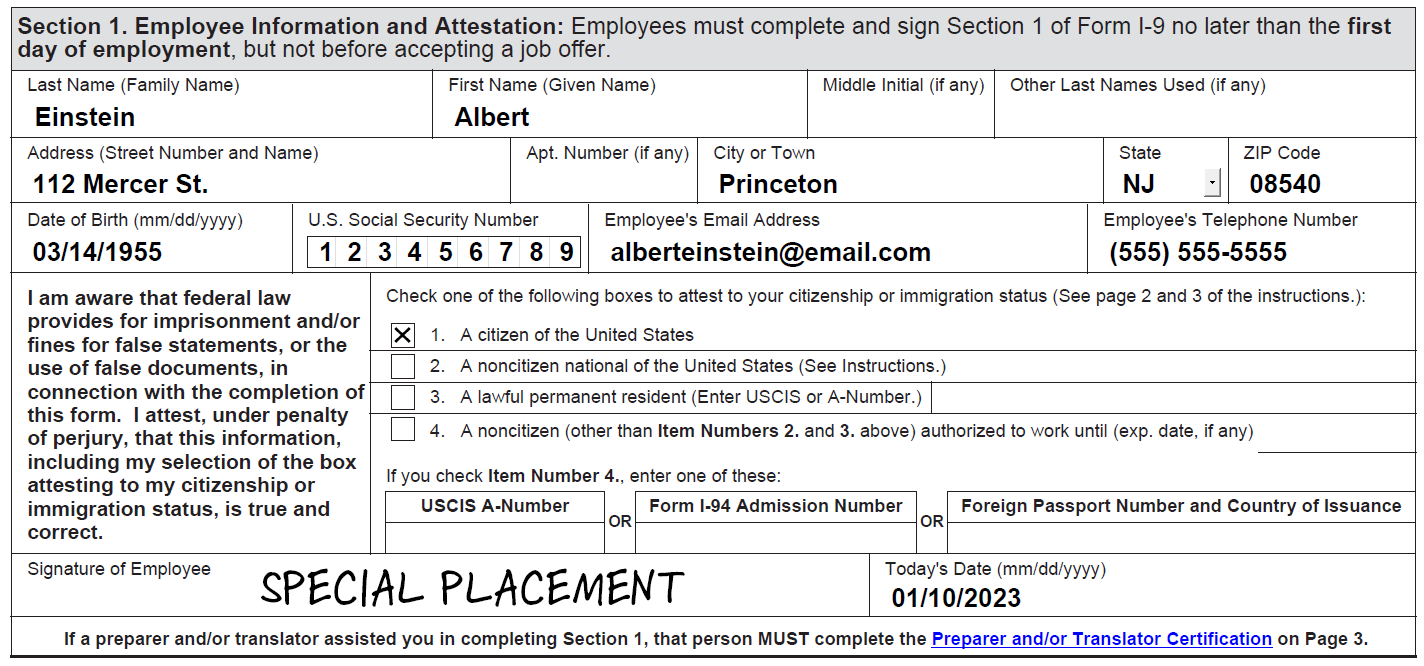

3.0 Completing Section 1: Employee Information and Attestation

Have the employee complete Section 1 at the time of hire (by the first day the employee starts work for pay or other remuneration) by entering the correct information and signing and dating the form. If the employee enters the information by hand, ensure the employee prints clearly.

A preparer and/or translator may help the employee complete Section 1. Employers must review the information and ensure employees (and their preparer/translators, if applicable) fully and properly completed Section 1.

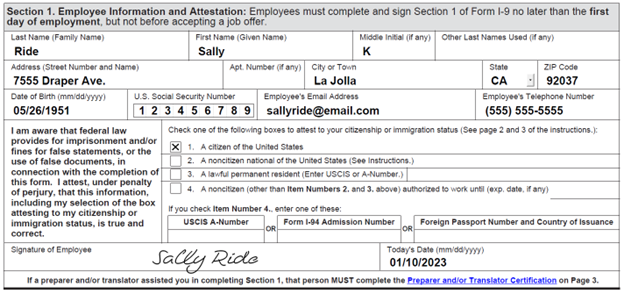

Figure 1a: Completing Section 1: Employee Information and Attestation

Employees must enter their current legal name and other last names that they have used in the past or present (such as a maiden name), if any.

- Employees with two last names (family names) must include both names in the Last Name field.

- Employees with only one name should enter it in the Last Name field and enter “Unknown” in the First Name field.

- Employees with two first names (given names) should include both in the First Name field.

- Employees whose first or last name includes a hyphen or apostrophe should include it.

- Examples of correctly entered last names include De La Cruz, O’Neill, Garcia Lopez, and Smith-Johnson.

- Examples of correctly entered first names include Mary Jo, John-Paul, Tae Young, and D’Shaun.

- Employees must enter their middle initial in the Middle Initial field. Employees who do not have a middle initial may leave this field blank.

- Employees must enter their maiden name or any other legal last name they may have used in the Other Last Names Used field. Employees who have not used other last names may leave this field blank.

Employees must enter their current address, apartment number (if any), city or town, state and ZIP code. If the residence is not located in a city or town, enter the village, county, township, reservation, etc. in the City or Town Field. Employees who do not have a street address should enter a description of the location of their residence, such as “Two miles south of I-81, near the water tower.” Employees who have no apartment number may leave this field blank. Border commuters from Canada or Mexico may enter their city; province or state; postal code; and their country abbreviation.

Employees must enter their date of birth as a two-digit month, two-digit day, and four-digit year (mm/dd/yyyy) in this field. For example, Jan. 8, 1980, should be entered as 01/08/1980.

Employees may voluntarily provide their Social Security number or leave this field blank. However, if you are enrolled in E-Verify, your employees must provide their Social Security number.

Employees who have not yet received their Social Security number and who can satisfy all other Form I-9 requirements may work while awaiting their Social Security number. Have them enter their Social Security number in Section 1 as soon as they receive it.

You cannot ask employees to provide a specific document with their Social Security number on it. To do so may constitute unlawful discrimination. For more information on E-Verify, see Section 1.2, E-Verify: The Web-Based Verification Companion to Form I-9. For more information on unlawful discrimination, see Section 11.0, Unlawful Discrimination and Penalties for Prohibited Practices.

Employees are not required to provide an email address or telephone number in Section 1. If they do not wish to enter an e-mail address or telephone number, they may leave these fields blank.

Employees must read the warning about penalties under federal law and attest to their citizenship or immigration status by checking one of the following boxes on the form:

- A citizen of the United States.

- A noncitizen national of the United States: An individual born in American Samoa, certain former citizens of the former Trust Territory of the Pacific Islands, and certain children of noncitizen nationals born abroad.

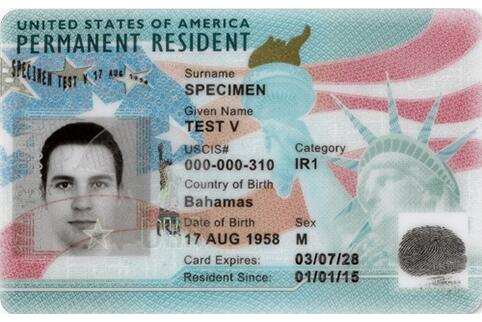

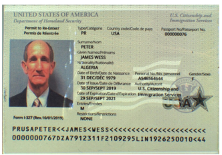

- A lawful permanent resident: This specific immigration status describes an individual who is not a U.S. citizen and who resides in the United States under legally recognized and lawfully recorded permanent residence as an immigrant. This term includes conditional residents, who should select this status. Employees who select this box should enter their seven- to nine-digit Alien Registration Number (A-Number) or USCIS Number in the space provided. The USCIS Number is the same as the A-Number without the “A” prefix. Asylees and refugees should NOT select this status, but should instead select “A noncitizen authorized to work.”

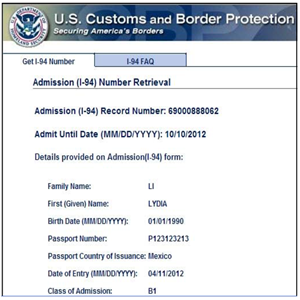

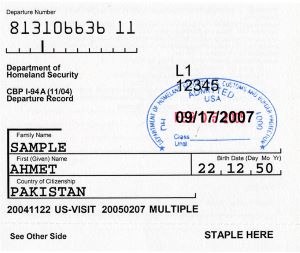

- A noncitizen (other than Item Numbers 2 or 3 above) authorized to work: An individual who is permitted to work in the United States, but is not a citizen or national of the United States, or a lawful permanent resident. For example, asylees, refugees, and certain citizens of the Federated States of Micronesia, the Republic of the Marshall Islands, or Palau should select this status. Employees who select box 4 must also enter the date their employment authorization expires. If it does not expire, the employee should enter N/A. If the employee’s employment authorization has been automatically extended, they should enter the expiration date of the automatic extension. Employees must also enter one of the following: Alien Registration Number (A-Number)/USCIS Number; Form I-94 Admission Number; or Foreign Passport Number and the Country of Issuance.

Employees must sign and date the form. Employees who cannot sign their name may place a mark in this field to indicate their signature.

If the employee uses a preparer and/or translator to help them complete and/or translate the form, each preparer and/or translator must complete a separate Preparer and/or Translator Certification block in Supplement A, Preparer and/or Translator Certification for Section 1.

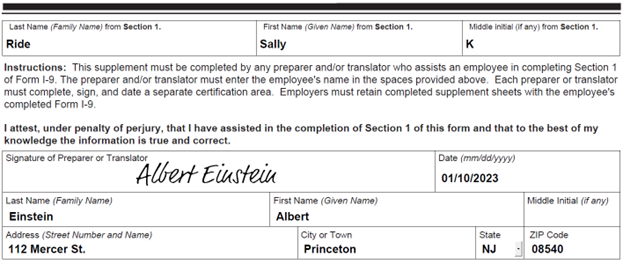

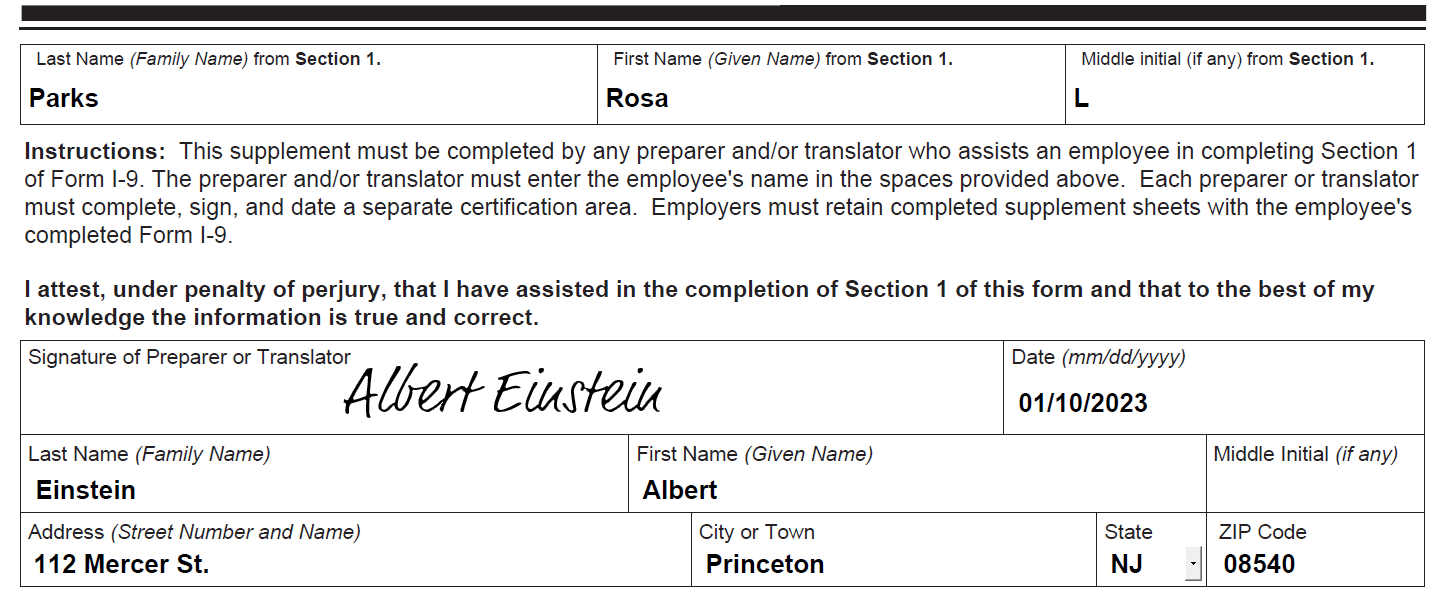

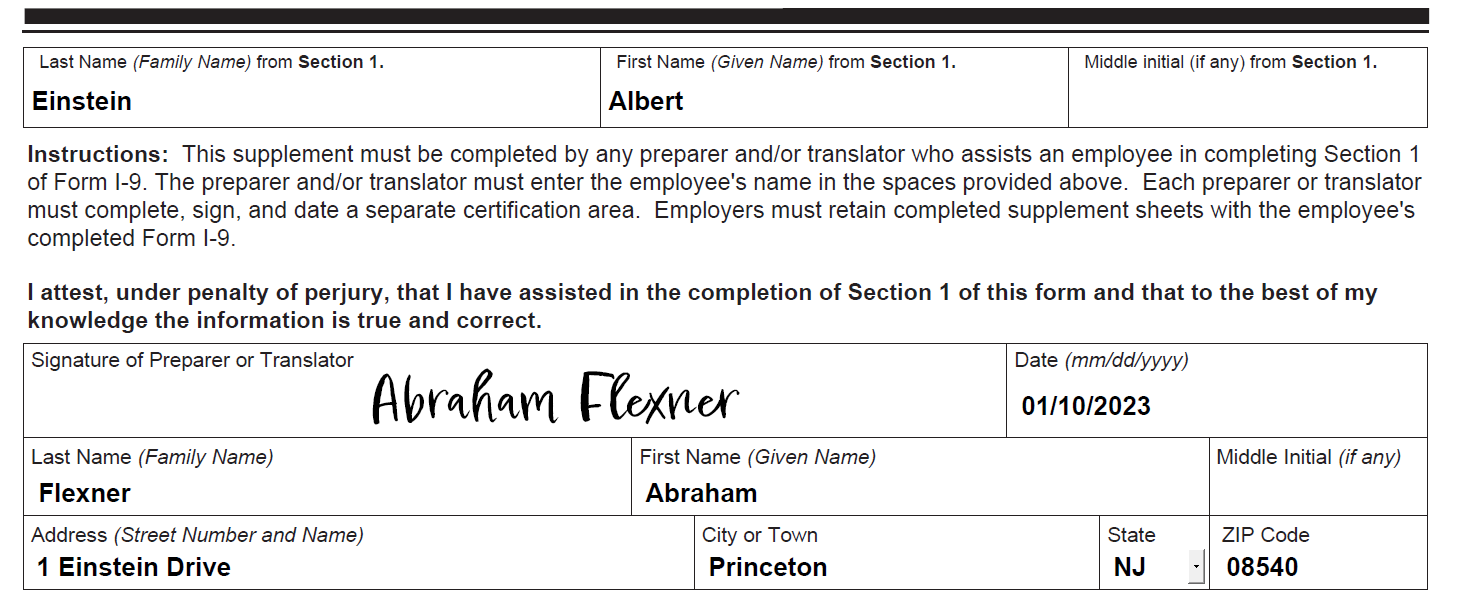

Figure 1b: Completing Supplement A: Preparer and/or Translator Certification for Section 1

- Preparers and/or translators may not enter a P.O. box in place of a physical address.

- Employees who use a preparer and/or translator to complete the form must still sign or make their mark in the Signature Field in Section 1.

- Employers may provide the employee additional supplement pages as needed and attach them to the employee’s completed form.

- The certification must also be completed for certain minors and employees in special placement who require a representative, parent, or legal guardian to complete Section 1 for them. See Sections 4.2 and 4.3 for more information.

You must ensure that all parts of Form I-9 are properly completed; or you may be subject to penalties under federal law. The employee must complete Section 1 no later than the employee’s first day of employment. You may not ask an individual who has not accepted a job offer to complete Section 1. Before completing Section 2, you should review Section 1 to ensure the employee completed it properly. You may review the employee’s document(s) and fully complete Section 2 at any time between the date the employee accepts the job offer and completes Section 1 to within three business days of the hire. Review any possible errors with the employee. The employee must correct any confirmed errors, add their initials, and the date they made the correction. Employers may not ask for documentation to verify the information entered in Section 1.

4.0 Completing Section 2: Employer Review and Verification

Within three business days of the date employment begins, you or your authorized representative must complete Section 2 by examining original, acceptable, and unexpired documentation, or an acceptable receipt, the employee presents (see Table 1: Special Form I-9 Situations) to determine if it reasonably appears to be genuine and relates to the person presenting it. For example, if an employee begins employment on Monday, you must review the employee’s documentation and complete Section 2 on or before Thursday of that week. However, if you hire someone for less than three business days, you must complete Section 2 no later than the first day of employment.

In general, you or your authorized representative must review the employee’s documentation in their physical presence. However, if you participate in E-Verify, you may also be eligible to remotely examine the employee’s documents under the alternative procedure authorized by the secretary of homeland security. To see if you are eligible and for further guidance, please see Section 4.5, Remote Document Examination (Optional Alternative Procedure to Physical Document Examination), as well as I-9 Central and E-Verify.gov.

You must allow the employee to choose which documentation they will present from the Form I-9 Lists of Acceptable Documents and must accept documentation that reasonably appears to be genuine and relates to the person presenting it. You cannot specify which documentation an employee will present from the Form I-9 Lists of Acceptable Documents. When physically examining documents, copies, except for certified copies of birth certificates, are not acceptable. See Section 4.5, Remote Document Examination (Optional Alternative Procedure to Physical Document Examination) requirements.

You may terminate an employee who fails to present acceptable documentation (or an acceptable receipt for a document) within three business days after the date employment begins. If you fail to properly complete Form I-9, you risk violating section 274A of the INA and may be subject to civil money penalties.

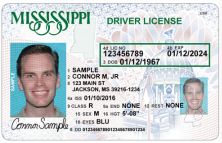

Employees may choose to present either: 1) one document selected from List A or 2.) a combination of one selection from List B and one selection from List C.

- List A documentation shows both identity and employment authorization. Some documentation must be presented together to be considered acceptable List A documentation. If an employee presents acceptable List A documentation, do not ask them to present List B or List C documentation.

- Under certain circumstances, USCIS may automatically extend an employee’s employment authorization and/or employment authorization document beyond the expiration date on the document. An automatically extended document is considered unexpired for Form I-9. See Section 5.0, Automatic Extensions of Employment Authorization and/or Employment Authorization Documents (EADs) in Certain Circumstances.

List B documentation shows identity only and List C documentation shows employment authorization only. If an employee presents acceptable List B and List C documentation, do not ask them to present List A documentation.

- If you participate in E-Verify, and the employee presents a combination of List B and List C documentation, then the List B document must contain a photograph. For more information, visit e-verify.gov.

Table 1 Special Form I-9 Situations

|

Special Situation |

Solution |

Additional M-274 Guidance |

|

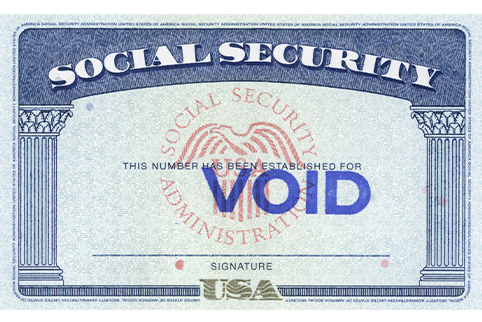

Employee presents a Social Security Card containing one of the following restrictions:

|

Because the restricted Social Security Card is not an acceptable List C document, ask the employee to provide a different document from List C or List A. |

|

|

Employee is a minor (individuals under age 18) and is unable to present an identity document from List B. |

Minor’s parent or legal guardian establishes identity for the minor by completing Section 1 on minor’s behalf and completing a Preparer and/or Translator Certification block in Supplement A. Minor must then only present an employment authorization document from List C. |

|

|

Employee who has a physical or mental impairment is placed in a job by a nonprofit organization, association, or as part of a rehabilitation program (special placement) and is unable to present an identity document for List B. |

Representative of the nonprofit organization, association, or rehabilitation program; parent; or legal guardian establishes identity for this employee by completing Section 1 on the employee’s behalf and completing a Preparer and/or Translator Certification. Employee must then only present an employment authorization document from List C. |

|

|

Employee has an expired EAD and/or employment authorization but qualifies for an automatic extension of employment authorization and/or Employment Authorization Document (EAD) by a Federal Register notice (FRN), a regulation, a Form I-797 or I-797C receipt notice, an individual letter/notice or a website notice. |

An EAD automatically extended by FRN or notice is an unexpired List A document for Form I-9. For more information on what the employee must present along with their EAD to complete Form I-9, please see Section 5. |

|

|

Employee presents an acceptable receipt in place of an unexpired List A, B, or C document. |

See Table 2 to determine how long each receipt is valid and what documents the employee must show once the receipt expires. |

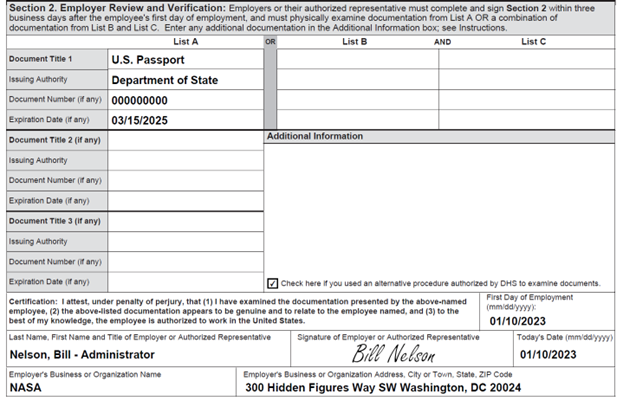

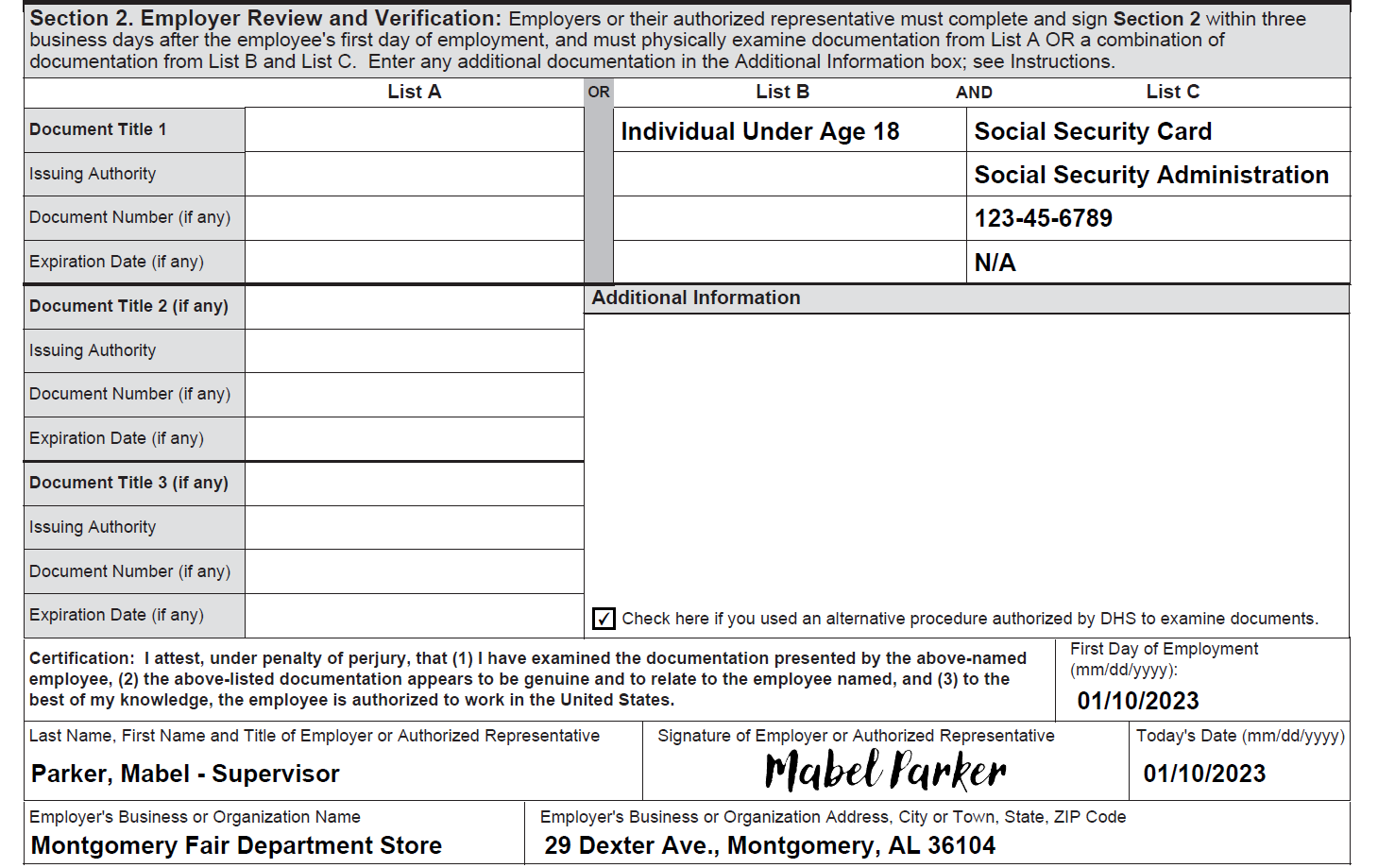

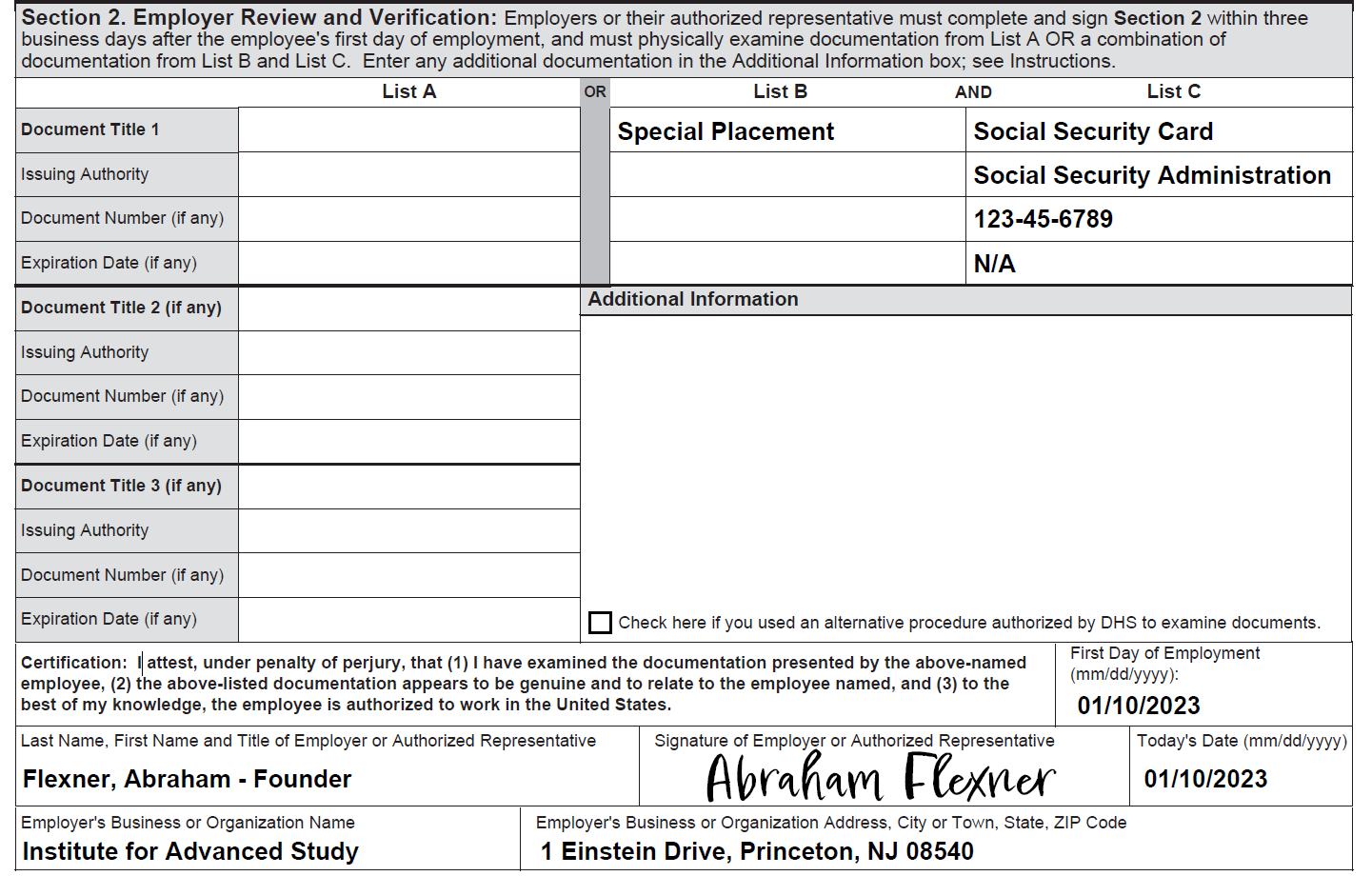

Figure 2: Section 2: Employer or Authorized Representative Review and Verification

When completing Section 2, use information from the documentation the employee presented to enter the document title, issuing authority, document number, and expiration date (if any) in Section 2:

- Enter List A documents in the column on the left. If the employee presents List A documentation that consists of multiple documents, use the second and third List A areas, as well as the Additional Information area, if necessary, to enter those other documents. If you enter documents in the List A columns, you should leave the List B and C columns blank.

- Enter List B documents in the center column. If you enter a document in this column, you must also enter a document in the List C column. Leave the List A column blank.

- Enter List C documents in the column on the right. If the employee presents a List C document that consists of multiple documents, use the Additional Information area to enter those other documents. If you enter a document in this column, you must also enter a document in the List B column. Leave the List A column blank.

You may use either common abbreviations for states, document titles or issuing authorities, such as “DL” for driver’s license and “SSA” for Social Security Administration. Appendix A provides more abbreviation suggestions.

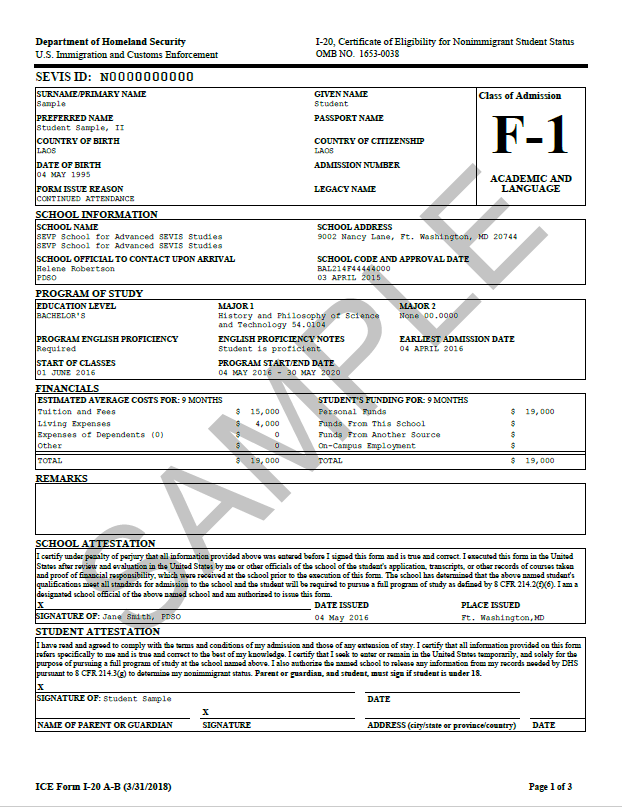

The “Additional Information” space is for Form I-9 notes, such as:

- Notations that describe extensions of employment authorization or a document’s expiration date for individuals in certain nonimmigrant categories or granted Temporary Protected Status (TPS). For more information, see Section 5.0, Automatic Extensions of Employment Authorization and/or Employment Authorization Documents (EADs) in Certain Circumstances, and Section 7, Evidence of Employment Authorization for Certain Categories.

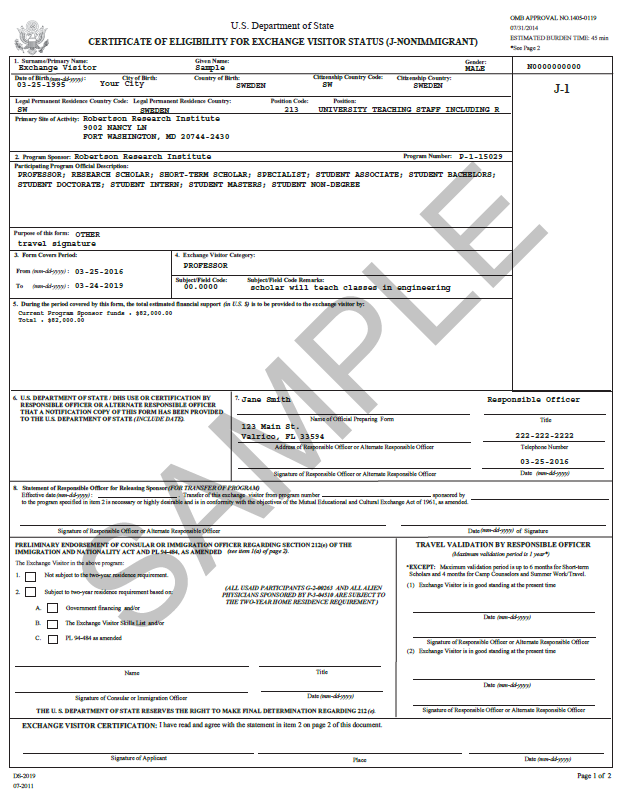

- Information from additional documents that F-1 or J-1 nonimmigrant employees may present including the Student and Exchange Visitor (SEVIS) number and the program end date from Form I-20, Certificate of Eligibility for Nonimmigrant Student Status, or DS-2019, Certificate of Eligibility for Exchange Visitor (J-1) Status, as required.

- Replacement document information if a receipt was previously presented.

- Discrepancies that E-Verify participants must notate when participating in the IMAGE program.

- Any other optional comments or notations necessary for your business process, such as employee termination dates, form retention dates, and E-Verify case verification numbers.

Enter the first day of employment for wages or other remuneration in the space for “The employee’s first day of employment (mm/dd/yyyy).” Recruiters and referrers for a fee do not enter the employee’s first day of employment.

Staffing agencies may choose to use either the date an employee is assigned to the employee’s first job or the date the new employee is entered into the assignment pool as the first day of employment.

The same person who examined the employee’s documents must also complete the fields in the certification block, then sign and date Section 2, as shown in Figure 2 above. The employer or authorized representative signs and dates Section 2 in the spaces provided to attest to examining the documents the employee presented. Also enter title, last name, first name, and the employer’s business or organization name.

Enter the business’s physical street address, city or town, state, and ZIP code. If the location is not a city or town you may enter the name of the village, county, township, reservation, etc. that applies. Employers may not enter a P.O. box as their address. If your company has multiple locations, use the most appropriate address that identifies the location of the employer.

4.1 Retaining Copies of Documents Your Employee Presents

You may make copies (or electronic images) of the documentation you reviewed, but must return original documentation to the employee. If you make copies, they should be made consistently for all new hires and reverified employees, regardless of national origin, citizenship, or immigration status, or you may violate anti-discrimination laws.

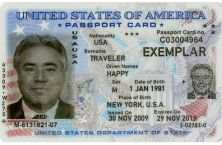

Employers participating in E-Verify are required to retain a copy of certain documents if the employee chooses to present them. These documents include the U.S. Passport, passport card, Permanent Resident Card (also called a Green Card), or Employment Authorization Document (EAD). If you are an E-Verify employer who chooses to copy documentation other than those you are required to copy for E-Verify, you should apply this policy consistently with respect to Form I-9 completion for all employees.

If you choose to remotely examine employees’ documents, you must retain clear and legible copies of the front and back (if two-sided) of ALL Form I-9 documentation an employee presents remotely with the employee’s Form I-9. For further guidance on remotely examining documents, please see Section 4.5, Remote Document Examination (Optional Alternative Procedure to Physical Document Examination), I-9 Central and E-Verify.gov.

You must always complete Section 2 by reviewing original documentation, even if you copy an employee’s document(s) after reviewing the documentation. You are still responsible for completing and retaining Form I-9.

You must retain copies and present them with Forms I-9 in case of an inspection by DHS, the Department of Labor or the Department of Justice.

4.2 Minors (Individuals under Age 18)

Minors can complete Form I-9 as described in Section 4.0, Completing Section 2 of Form I-9, by presenting a List A document or a combination of List B and C documents. If a minor is unable to present an identity document from List B, a parent or legal guardian may establish identity for the minor by completing Form I-9 as shown in Figures 3a and 3b.

If you participate in E-Verify, parents or legal guardians cannot establish identity for a minor as described above. The minor must present either a List A document, or a combination of a List B document that contains a photograph and a List C document.

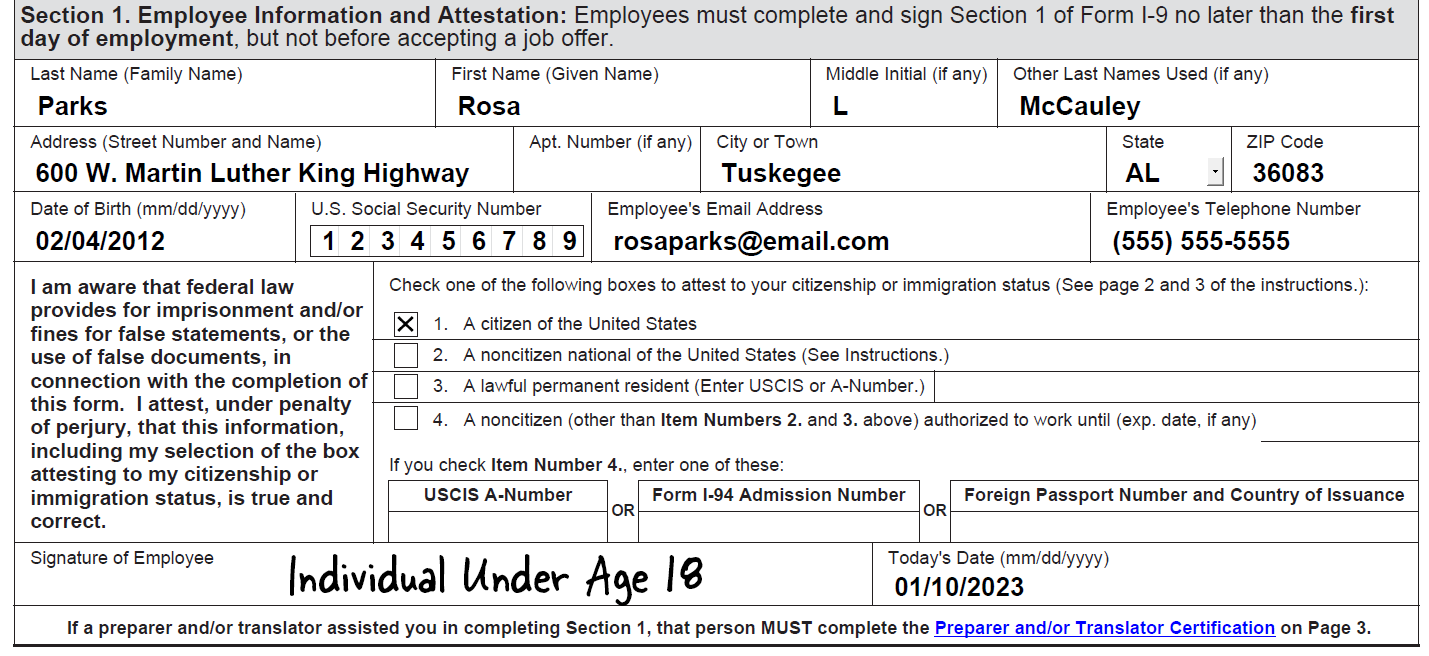

Figure 3a: Completing Section 1 of Form I-9 for Minors without List B Documents

The minor’s parent or legal guardian completes Section 1 and enters “Individual under age 18” in the signature block. The parent or legal guardian completes a Preparer and/or Translator Certification block on Supplement A: Preparer and/or Translator Certification for Section 1.

Figure 3b: Completing Supplement A: Preparer and/or Translator Certification for Minors without List B Documents

Figure 4: Completing Section 2 of Form I-9 for Minors without List B documents

- Enter “Individual under age 18” under List B and under List C, enter the document title, issuing authority, document number, and expiration date (if any) using information from the List C document the minor presented.

- Enter the date employment began.

- You or your authorized representative signs and dates Section 2 in the spaces provided to attest to examining the documents the employee presented. Also enter your title, last name and first name, as well as the employer’s business or organization name.

- Enter the business’s street address, city or town, state and ZIP code.

4.3 Employees with Disabilities (Special Placement)

Certain employees may have a physical or mental impairment which substantially limits one or more of their major life activities and are placed in jobs by a nonprofit organization, association, or as part of a rehabilitation program. Employees in this category who present List A documentation, or a combination of List B and C documentation, must complete Form I-9 as described in Section 4.0, Completing Section 2: Employer Review and Verification. If these employees are unable to present a List B document, they may establish identity under List B similar to minors, as shown in Figures 5a and 5b. These employees must still present a List C document.

If you participate in E-Verify, representatives of a nonprofit organization, association, or rehabilitation program; parents; and legal guardians cannot establish identity for an employee with disabilities as described above. This employee must present either List A documentation, or a combination of a List B document that contains a photograph and a List C document.

Figure 5a: Completing Section 1 of Form I-9 for Employees with Disabilities (Special Placement)

The representative of the nonprofit organization, association, or rehabilitation program; or the parent or legal guardian of the employee with a disability completes Section 1 and enters “Special Placement” in the Signature of Employee field and dates the form.

Figure 5b: Completing Supplement A for Employees with Disabilities (Special Placement)

The same representative, parent, or legal guardian completes a Preparer and/or Translator Certification block on Supplement A: Preparer and/or Translator Certification for Section 1.

Figure 6: Completing Section 2 of Form I-9 for Employees with Disabilities (Special Placement)

- Enter “Special Placement” under List B and under List C, enter the document title, issuing authority, document number, and expiration date (if any) using information from the List C document the employee presented.

- Enter the date employment began.

- You or your authorized representative signs and dates Section 2 in the spaces provided to attest to examining the documents the employee presented. Whoever signs should also enter their title, last name, and first name, as well as the employer’s business or organization name.

- Enter the business’s street address, city or town, state, and ZIP code.

4.4 Acceptable Receipts

You must accept a receipt in place of List A, B, or C documentation if the employee presents one, unless employment will last less than three business days. New employees who choose to present a receipt must do so within three business days after their first day of employment, or for reverification or existing employees, by the date that their employment authorization expires.

Table 2 provides a list of acceptable receipts an employee can show. Enter the word “Receipt” followed by the title of the document in Section 2 under the list that relates to the receipt.

When your employee presents the original replacement document, cross out the word “Receipt,” then enter the information from the new documentation into the Additional Information field in Section 2, and initial and date the change.

Accepting a second receipt at the end of the initial receipt validity period is not permissible.

Table 2 Acceptable Receipts

|

Description of Receipt |

Who may present this receipt? |

Is this a List A, B, or C document? |

How long is this receipt valid for Form I-9 purposes? |

What document must the employee show at the end of the receipt validity period? |

|

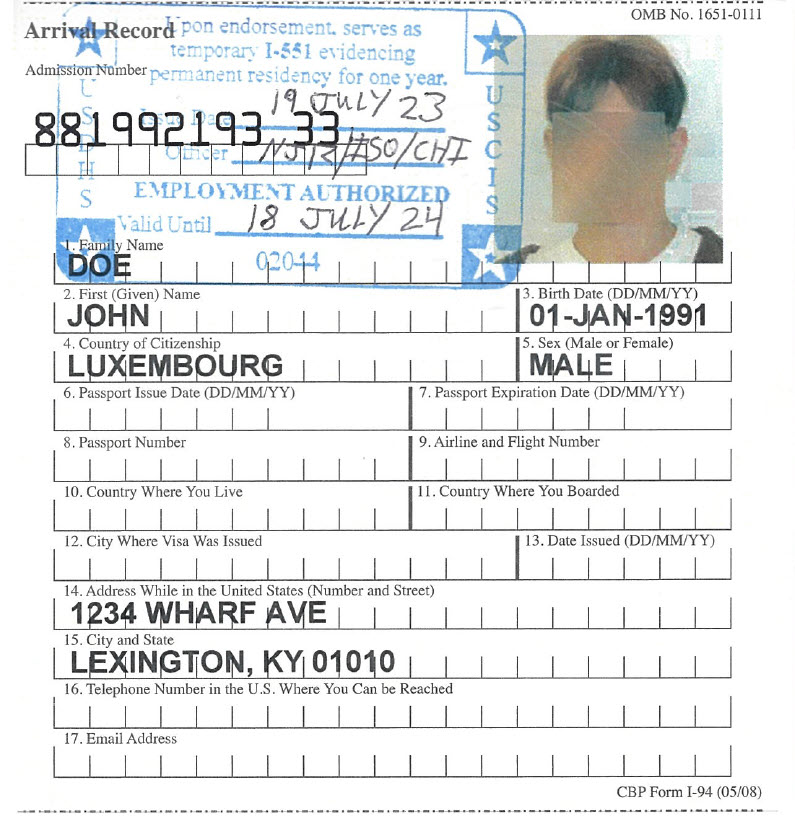

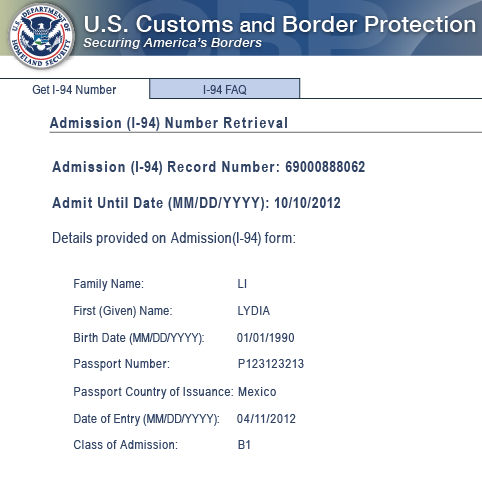

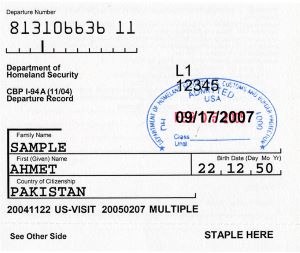

The departure portion of a Form I-94, Arrival/Departure Record, with an unexpired refugee admission stamp or admission code of “RE.” |

Refugees |

List A |

90 days from date of hire or, for reverification, 90 days from the date employment authorization expires. |

An unexpired Employment Authorization Document (Form I-766), or a combination of a valid List B document and an unrestricted Social Security card. |

|

The arrival portion of a Form I-94, Arrival/Departure Record, containing a temporary I-551 (otherwise known as the Alien Documentation, Identification and Telecommunication (ADIT)) stamp and photograph. |

Lawful permanent residents |

List A |

Until the expiration date of the temporary I-551 (ADIT) stamp, or if there is no expiration date, one year from date of admission. |

The actual Form I-551, Permanent Resident Card, also known as a “Green Card.” |

|

A document that shows an employee applied to replace a lost, stolen, or damaged document. |

All employees |

Can be List A, B, or C, depending on which document the receipt relates to. |

90 days from date of hire or, for reverification, 90 days from the date employment authorization expires. |

The actual replacement document. You may also accept other Form I-9 documentation from the Lists of Acceptable Documents. If you accept documentation other than the actual replacement document, record the document information on Section 2 of a new Form I-9 and attach it to the original Form I-9. You should also note in the Additional Information box on the new Form I-9 the reason that documentation other than the replacement document was presented – for example, document delays, changes in status, or other factors – and sign and date the note.

|

|

Unexpired Form I-94, Arrival/Departure Record, containing a class of admission of UHP or OAR on the document or unexpired Form I-94 containing a class of admission of PAR and indicates Afghanistan as country of citizenship on the document

|

Certain Parolees |

List A |

90 days (or when the I-94 expires, if less) from date of hire or, for reverification, the date employment authorization expires. |

An unexpired Employment Authorization Document (EAD), or an unrestricted Social Security card and a List B identity document from the Form I-9 Lists of Acceptable Documents. |

|

An unexpired Form I-94, Arrival/Departure Record that contains a class of admission of DT issued between Feb. 24, 2022, and Sept. 30, 2023, and indicates Ukraine as the country of citizenship on the document

|

Ukrainian citizen parolees |

List A |

90 days (or when the I-94 expires, if less) from date of hire or, for reverification, the date employment authorization expires. |

An unexpired Employment Authorization Document (EAD), or an unrestricted Social Security card and a List B identity document from the Form I-9 Lists of Acceptable Documents. |

4.5 Remote Document Examination (Optional Alternative Procedure to Physical Document Examination)

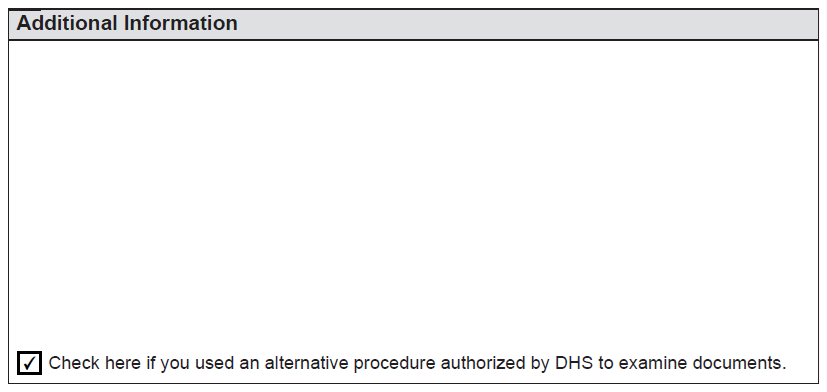

Employers who participate in E-Verify in good standing are qualified to remotely examine their employee’s documentation using a DHS-authorized alternative procedure at their E-Verify hiring sites. This includes the use of an authorized representative acting on your behalf, such as a third-party vendor. If you choose to offer the alternative procedure to new employees at an E-Verify hiring site, you must do so consistently for all employees at that site. However, you may choose to offer the alternative procedure for remote hires only but continue to apply physical examination procedures to all employees who work onsite or in a hybrid capacity, so long as you do not adopt such a practice for a discriminatory purpose or treat employees differently based on their citizenship, immigration status, or national origin, such as by deciding that certain employees are not eligible for remote examination of their documentation. To examine your employee’s documentation remotely, you must be enrolled in good standing in E-Verify, and complete the following steps:

- Examine copies (front and back, if the document is two-sided) of Form I-9 documents or an acceptable receipt to ensure that the documentation presented reasonably appears to be genuine;

- Conduct a live video interaction with the individual presenting the document(s) to ensure that the documentation reasonably appears to be genuine and related to the individual. The employee must first transmit a copy of the document(s) to the employer (per Step 1 above) and then present the same document(s) during the live video interaction;

- Indicate on the Form I-9, by completing the corresponding box, that an alternative procedure was used to examine documentation to complete Section 2 or for reverification in Supplement B, as applicable; and

- Retain a clear and legible copy of the documentation (front and back if the documentation is two-sided).

In the event of a Form I-9 audit by a federal government official, make available the clear and legible copies of the identity and employment authorization documentation presented by the employee for document examination in connection with the employment eligibility verification process.

Figure 7: Checkbox in Section 2 to Indicate Remote Documentation Examination

Continue to complete the Form I-9 according to Form I-9 instructions and related guidance on I-9 Central and in the M-274, Handbook for Employers.

5.0 Automatic Extensions of Employment Authorization and/or Employment Authorization Documents (EADs) in Certain Circumstances

Some noncitizens with a pending Form I-765, Application for Employment Authorization, EAD renewal application filed under certain employment eligibility codes may be eligible to receive an up to 540-day automatic extension of their employment authorization and/or EAD if they meet the requirements stated in Sections 5.1 or 5.3. The increased automatic extension of employment authorization and/or EAD from up to 180 days to up to 540 days is authorized by two DHS temporary final rules published in the Federal Register:

- The first temporary final rule applies to eligible EAD renewal applications that were timely filed between May 4, 2022, and Oct. 26, 2023, and can be found at 87 FR 26614.

- The second temporary final rule applies to eligible EAD renewal applications that were timely filed between Oct. 27, 2023, and Sept. 30, 2025, and can be found at 89 FR 24628.

Under these temporary final rules, eligible employees with EADs that contain certain category codes are generally eligible for an automatic extension of their employment authorization and/or EADs for up to 540 days from the “Card Expires” date on the face of the EAD. See Figure 8 for an example that shows how to locate the category code and expiration date on an employee’s EAD.

Figure 8: Finding the Category Code and Expiration Date on an EAD (Form I-766)

The eligibility category appears on the EAD under “Category.” The expiration date appears to the right of “Card Expires,” see Figure 8 below:

5.1 Automatic Extensions Based on a Timely Filed Application to Renew Employment Authorization and/or Employment Authorization Document

Some noncitizens in certain employment eligibility categories who timely file Form I-765, Application for Employment Authorization, to renew their employment authorization and/or EADs may receive automatic extensions of their employment authorization and/or EADs for up to 540 days while their renewal applications remain pending.

Those who timely and properly file(d) their EAD renewal applications between May 4, 2022, and Oct. 26, 2023, or between April 8, 2024, and Sept. 30, 2025, may be eligible to receive an extension of up to 540 days as provided by temporary final rules 87 FR 26614 and 89 FR 24628. Employees who timely filed their EAD renewal applications on or after Oct. 27, 2023, but before April 8, 2024, and whose applications remain pending on or after April 8, 2024, are also eligible to receive an extension of up to 540 days as provided by 89 FR 24628. The extension begins on the “Card Expires” date on face of their EAD and generally continues for up to 540 days as applicable, or until USCIS adjudicates the renewal application, whichever comes earliest. An automatic extension of employment authorization and/or EAD validity depends on these eligibility requirements:

- Employees must have timely and properly filed an application to renew their employment authorization and/or EAD on Form I-765, Application for Employment Authorization, before the EAD expires, and the Form I-765 EAD renewal application remains pending. Exception: Employees with EADs based on Temporary Protected Status (TPS) (A12 and C19), whose EAD renewal applications were filed during the re-registration period described in the Federal Register notice applicable to their country’s TPS designation, may receive the automatic extension, even if their renewal application was filed after the expiration date on the EAD.

- The eligibility category on the front of the employee’s EAD must have the same eligibility category as the employee’s Form I-797C, Notice of Action, issued for the corresponding EAD renewal application. Exceptions:

- In the case of an EAD and I-797C, Notice of Action, where each contains either an A12 or C19 TPS category code, the category codes do not have to match.

- For H-4 (C26), E (A17) and L-2 (A18) dependent spouses, an unexpired Form I-94 indicating H-4, E, or L-2 nonimmigrant status, including E-1S, E-2S, E-3S and L-2S class of admission codes, must accompany Form I-797C.

- Employees must have one of these qualifying eligibility categories to receive an automatic extension of their employment authorization and/or EAD validity: A03, A05, A07, A08, A10, A17*, A18*, C08, C09, C10, C16, C20, C22, C24, C26*, C31, and A12 or C19. The eligibility categories are published on the USCIS Automatic EAD Extension page. Some category codes on the EAD may include the letter ‘P’ such as C09P. Employers should disregard the letter ‘P’ when comparing the category code on the EAD with the category code on the Form I-797C, Notice of Action. *There are limitations on employees who file a Form I-765 renewal application within categories A17, A18, and C26 for an automatic extension. See A17, A18, and C26 guidance below.

If an employee is eligible for the automatic extension, acceptable proof of employment authorization and/or EAD validity during the automatic extension period includes: an EAD that appears expired on the face of the card presented with a Form I-797C, Notice of Action, that shows a timely filed EAD renewal application in the same employment eligibility category as the EAD (except TPS-based EADs and notices, which could have A12 or C19 category codes). See Automatic EAD Extensions for Temporary Protected Status (TPS) Beneficiaries in Section 5.3 for information on TPS-based EAD automatic extensions that may not require a Form I-797C, Notice of Action, and Guidance for Employees under Category Codes A17, A18, and C26 for information about the additional unexpired Form I-94 documentation that H-4, E, and L-2 dependent spouses need to present with a Form I-797C, Notice of Action.

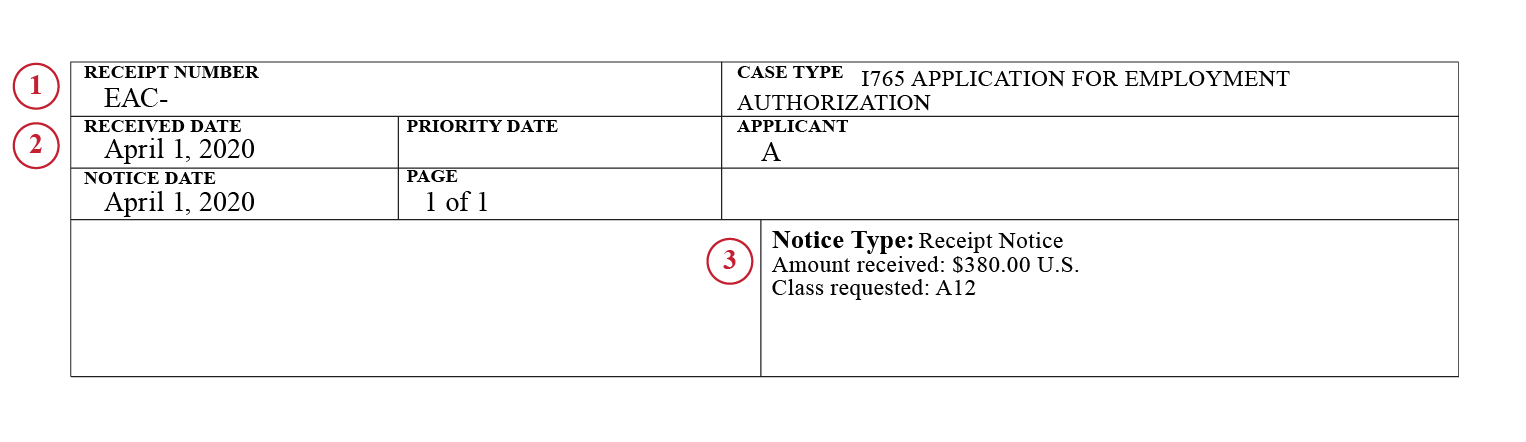

Finding Information on Form I-797C: Sample A

I-797 RECEIPT NOTICE EXEMPLAR

The receipt number appears on Form I-797C, Notice of Action, in the Receipt Number field, as noted in number 1.

The filing date (the date USCIS received the application) appears in the Received Date field, as noted in number 2. Except as explained below for TPS beneficiaries, this date should be on or before the “Card Expires” date on the EAD. Also, if the “Received Date” is between May 4, 2022, and Sept. 30, 2025, the automatic extension period is up to 540 days from the “Card Expires” date on the face of the EAD. Certain TPS beneficiaries are eligible for this extension if they have timely and properly filed to renew their EAD during the re-registration period as directed in the Federal Register Notice applicable to their country’s TPS designation. Therefore, the filing date on a TPS beneficiary’s Form I-797C might be after the “Card Expires” date on their TPS-based EAD. For more information, go to https://www.uscis.gov/humanitarian/temporary-protected-status.

The category may appear on Form I-797C in the Class Requested field, as noted in number 3. If you do not see this field, see Sample B below.

Finding Information on Form I-797C: Sample B

I-797 RECEIPT NOTICE EXEMPLAR

The receipt number appears on Form I-797C in the Receipt Number field, as noted in number 1.

The filing date (the date USCIS received the application) appears in the Received Date field, as noted in number 2. This date should be on or before the “Card Expires” date on the EAD, unless the EAD renewal application and EAD are based on TPS. For TPS-based EADs, the date may be after the “Card Expires” date on the EAD (but must be during the re-registration period stated in the applicable TPS Federal Register Notice). See Section 5.3. The category may appear on Form I-797C in the Eligible Category field, as noted in number 3. The category may appear on Form I-797C in the Eligible Category field, as noted in number 3.

How to Complete Form I-9 for EADs Automatically Extended Based on a Pending Form I-765 Renewal Application

New Employees

New employees presenting an EAD that has been automatically extended must complete Section 1 as follows:

- Select “A noncitizen authorized to work until;” and

- Enter the date that is 540 days from the “Card Expires” date on the EAD as the expiration date of employment authorization. Employees whose status does not expire, such as refugees or asylees, should enter “N/A” as the expiration date.

In Section 2, in the List A column, the employer must:

- Enter “EAD” in the Document Title field.

- Enter the Card Number from the EAD in the Document Number field.

- In the Expiration Date field, enter the date 540 days from the “Card Expires” date on the EAD if the “Received Date” on Form I-797C is between May 4, 2022, and Sept. 30, 2025.

For automatic extensions the employer should enter “EAD EXT” in the Additional Information field. Additionally, since your employee’s extension is for up to 540 days, you may keep a copy of the USCIS webpage describing the temporary extension of up to 540 days with the employee’s Form I-9.

You may use the Employment Authorization Document (EAD) Automatic Extension Calculator to determine extended expiration dates.

Rehired Employees

For employees rehired within three years from the date you completed the employee’s previous Form I-9 and who qualify for this extension, you must complete Form I-9 following the process described above or in Section 6.2. If the employee’s original Form I-9 was completed on a Form I-9 that is no longer valid, you must either complete the latest version of Form I-9 or Supplement B, Reverification and Rehire, and attach it for this employee.

Current Employees

For a current employee whose employment authorization and/or EAD has been automatically extended and who presents a Form I-797C, Notice of Action, you must update Form I-9 enter the appropriate automatic extension expiration date in the Section 2 Additional Information field. Employers should also enter “EAD EXT” in the Additional Information field and may keep a copy of the USCIS webpage describing the temporary extension of up to 540 days with the employee’s Form I-9, if applicable. If the employee’s original Form I-9 was completed on a Form I-9 that is no longer valid, enter EAD EXT and the new expiration date in the Additional Information field in Section 2 of the latest version of Form I-9 and retain it with the employee’s original Form I-9.

Guidance for Employees under Category Codes A17, A18, and C26

Employees with EADs with category codes A17, A18, and C26 require additional documentation supplementing the Form I-797C, Notice of Action, to show that the EAD has been automatically extended. These employees must present a Form I-94, Arrival/Departure record indicating unexpired nonimmigrant status (E-1, E-1S, E- 2, E-2S, E-3, E-3S, H-4, L-2 or L-2S), along with a Form I-797C, Notice of Action, that shows a timely-filed EAD renewal application stating the “Class requested” as “(A17),” “(A18),” or “(C26),” and the EAD that appears expired on the face of the card as having been issued under the same category (that is, Category A17, A18, or C26).

For a new employee, in Section 2, in the List A column, the employer must:

- Enter “EAD” in the Document Title field.

- Enter the Card Number from the EAD in the Document Number field.

- In the Expiration Date field, enter the date that is 540 days from the “Card Expires” date on the EAD if the “Received Date” on Form I-797C is between May 4, 2022, and Sept. 30, 2025, or the end date of the Form I-94, whichever is earlier.

- Enter the Form I-94 document information in the second set of List A Document entry fields.

To calculate the new expiration date:

- Add 540 to the EAD “Card Expires” date.

- Compare the 540-day auto-extended date to the Form I-94 end date.

- Whichever date is earlier is the new EAD expiration date.

The employer should enter “EAD EXT” in the Additional Information field in Section 2. If applicable, you may keep a copy of the USCIS webpage describing the temporary EAD extension of up to 540 days with the employee’s Form I-9. Employers must reverify employment authorization at the end of the automatic extension period.

Updating Form I-9 for an Employee with An Existing 180-Day Automatic Extension

If your employee’s Form I-797, Notice of Action, for their EAD renewal application has a Received Date of Oct. 27, 2023, through April 7, 2024, and refers to a 180-day extension, and the EAD renewal application is still pending on or after April 8, 2024, the employee is eligible to receive an additional extension of 360 days as provided in the temporary final rule (FR 24628), for a total of 540 days counted from the “Card Expires” date stated on the face of the EAD. Employees whose EAD Category Codes are A17, A18, and C26 may not necessarily receive the full 360-day extension, and this is explained below in the For Category Codes A17, A18, and C26 guidance.

You must update the Additional Information field in Section 2 of the employee’s Form I-9 to include the new EAD expiration date no later than the date the employee’s 180-day automatic extension will end. Employers are not required to re-examine documents; however, your employee may present a Form I-797C, Notice of Action, EAD and, if applicable, Form I-94 again if you need to re-examine the “Card Expires” date and the category code(s) to determine eligibility and/or accurately calculate the increased automatic extension.

Your employee’s Form I-797C, Notice of Action, that refers to an automatic EAD extension of up to 180 days is acceptable evidence of the extension of up to 540 days, provided the above-described eligibility requirements are satisfied.

You should update the employee’s original Form I-9 to add 360 days to the employee’s EAD 180-day automatic extension date located in Section 2. You could also determine the automatic extension date by adding 540 days to the “Card Expires” date shown on the EAD. If the employee’s original Form I-9 was completed on a Form I-9 version that is no longer valid, you should enter the new EAD expiration date in the Additional Information field in Section 2 of a new Form I-9 and retain it with the employee’s original Form I-9.

Employers may keep a copy of the USCIS webpage describing the temporary EAD extension of up to 540 days with the employee’s Form I-9.

For Category Codes A17, A18, and C26

This guidance applies to employees who fall within category codes A17, A18, or C26 and therefore are either H-4, E, or L-2 dependent spouses, including E-1S, E-2S, E-3S and L-2S class of admission codes listed on Form I-94. Your employee’s automatic extension period cannot exceed the Form I-94 end date. Under this circumstance, your employee could have an extension that is greater than 180 days but less than the additional 360 days.

Your employee’s Form I-797C, Notice of Action, may refer to an automatic EAD extension of up to 180 days and is acceptable evidence of the 540-day extension, but cannot exceed the Form I-94 end date, provided the above-described eligibility requirements are satisfied.

In the Additional Information field of Section 2, you should enter either the Form I-94 end date or the EAD “Card Expires” date plus up to 360 days, whichever date is earlier. Note that if the employee’s original Form I-9 was completed on a Form I-9 version that is no longer valid, you should enter the new expiration date in the Additional Information field in Section 2 of a new Form I-9, initial and date the notation, and retain it with the employee’s original Form I-9.

Reverification

You must reverify employees’ employment authorization when the automatic extension of their employment authorization and/or EAD ends (whichever is earlier). You can reverify temporary employment authorization before the automatic extension ends if an employee presents any acceptable, unexpired document that shows employment authorization, such as any acceptable document from List A or C.

5.2 Temporary Increase of Automatic Extension of EADs from 180 Days to 540 Days

You must reverify employees’ employment authorization when the automatic extension of their employment authorization and/or EAD ends (whichever is earlier). You can reverify temporary employment authorization before the automatic extension ends if an employee presents any acceptable, unexpired document that shows employment authorization, such as any acceptable document from List A or C.

Updating Form I-9 for an Employee with An Existing 180-Day Automatic Extension

If your employee’s Form I-9 was completed on or after May 4, 2022, showed an EAD that was automatically extended by 180 days, the employee was eligible to receive an additional extension of 360 days as provided in the temporary final rule (87 FR 26614), for a total of 540 days counted from the “Card Expires” date stated on the face of the EAD. Employees whose EAD Category Codes are A17, A18 and C26 may not necessarily receive the full 360-day extension, and this is explained below in the For Category Codes A17, A18, and C26 guidance.

You must have updated the Additional Information field in Section 2 of the employee’s Form I-9 to include the new expiration date no later than the date the employee’s 180-day automatic extension ended. Employers were not required to re-examine documents; however, your employee may have presented a Form I-797C, Notice of Action, EAD and, if applicable, Form I-94 again if you needed to re-examine the “Card Expires” date and the category code(s) to determine eligibility and/or accurately calculate the increased automatic extension.

Your employee’s Form I-797C, Notice of Action, may have referred to an automatic EAD extension of up to 180 days and was acceptable evidence of the extension of up to 540 days, provided the above-described eligibility requirements are satisfied.

You should have updated the employee’s original Form I-9 to add 360 days to the employee’s EAD 180-day automatic extension date located in Section 2. You could have also determined the automatic extension date by adding 540 days to the “Card Expires” date shown on the EAD. Note that if the employee’s original Form I-9 was completed on a Form I-9 version that was no longer valid, you should have entered the new EAD expiration date in the Additional Information field in Section 2 of a new Form I-9 and retained it with the employee’s original Form I-9.

Employers may keep a copy of the USCIS webpage describing the temporary EAD extension of up to 540 days with the employee’s Form I-9.

For Category Codes A17, A18, and C26

This guidance applied to employees who fell within category codes A17, A18, or C26 and therefore were either H-4, E, or L-2 dependent spouses, including E-1S, E-2S, E-3S and L-2S class of admission codes on Form I-94. Your employee’s automatic extension period could not exceed the Form I-94 end date. Under this circumstance, your employee could have had an extension that was greater than 180 days but less than the additional 360 days.

Your employee’s Form I-797C, Notice of Action, may have referred to an automatic EAD extension of up to 180 days but was acceptable evidence of the extension of up to 540 days, but could not exceed the Form I-94 end date, provided the above-described eligibility requirements were satisfied.

In the Additional Information field of Section 2, you should have entered either the Form I-94 end date or the EAD “Card Expires” date plus up to 360 days, whichever date was earlier. Note that if the employee’s original Form I-9 was completed on a Form I-9 version that is no longer valid, you should have entered the new expiration date in the Additional Information field in Section 2 of a new Form I-9, initialed and dated the notation, and retained it with the employee’s original Form I-9.

Employment Authorization Resumption for Certain Categories Whose 180-Day Extension Had Expired as of May 4, 2022

(This guidance no longer applies to newly hired employees.) At its inception, the temporary final rule sought to reinstate expired EADs for certain categories who had a 180-day automatic extension that had passed without having received a new EAD. Beginning May 4, 2022, employment eligibility and/or EAD validity resumed for a period not to exceed 540 days from the “Card Expires” date on the EAD for qualifying noncitizens with a pending renewal Form I-765, Application for Employment Authorization, who experienced a gap in employment authorization and/or the validity of their EAD because their 180-day automatic extension ended prior to May 4, 2022.

The rule did not cure any unauthorized employment that may have accrued prior to issuance of the rule. To calculate whether there was any automatic extension time remaining, employers counted 540 days from the expiration date stated on the front of the EAD. If an employee fell within category codes A17, A18, or C26 and therefore were either H-4, E, or L-2 dependent spouses, including E-1S, E-2S, E-3S and L-2S class of admission codes on Form I-94, employers counted up to either 540 days or the expiration date on Form I-94, whichever was earlier. The last possible automatic extension based on this resumption of employment authorization was valid through April 28, 2023.

Your employee’s Form I-797C, Notice of Action, may have referred to an automatic EAD extension of up to 180 days and when combined with their EAD, was acceptable evidence of the extension of up to 540 days, provided that the above-described eligibility requirements were satisfied.

Reverification

You should have reverified employees’ employment authorization when their automatic extension ended, and no later than the date their employment authorization expired.

5.3 Automatic EAD Extensions for Temporary Protected Status (TPS) Beneficiaries

DHS may extend the expiration date of a TPS beneficiary’s EAD either by Federal Register notice or an individual notice mailed to the beneficiary. Based on the temporary final rule (89 FR 24628), certain TPS beneficiaries are eligible for an EAD extension based on the timely and proper filing to renew their EAD. For TPS-based EADs, timely filing under the temporary final rule means the EAD renewal application is filed during the TPS re-registration period indicated in the Federal Register notice for their country’s designation (for more information, see Section 5.1 Automatic Extensions Based on a Timely Filed Application to Renew Employment Authorization and/or Employment Authorization Document). You may not ask employees to prove they are nationals of a country that DHS has designated for TPS.

Automatic Extensions by Federal Register Notice (FRN)

FRNs announcing TPS actions generally include an automatic extension of the expiration date of all associated TPS EADs that contain a specific “Card Expires” date and a category code of A12 or C19. The FRNs provide detailed instructions for completing or updating Form I-9. For TPS EAD automatic extension information, check the USCIS TPS webpage.

How to Complete Form I-9 for EADs Extended by FRN

In Section 1, new employees presenting an EAD automatically extended by FRN must:

- Select “A noncitizen authorized to work;” and

- Enter the EAD automatic extension date provided in the appropriate FRN as the expiration date. Employees can find a link to their TPS country’s FRN on the USCIS TPS webpage.

In Section 2, in the List A column, the employer must:

- Enter “EAD” in the Document Title field.

- Enter the document number from the EAD with Category A12 or C19, as applicable.

- Enter the automatic extension date provided in the FRN as the document expiration date.

For a current employee whose EAD has been automatically extended by FRN, employers must provide updated information on Form I-9. They should enter “EAD EXT” and the EAD automatic extension date from the FRN in the Additional Information field in Section 2. For example, EAD EXT mm/dd/yyyy. If the employee’s original Form I-9 was completed on a Form I-9 version that is no longer valid, complete the latest version of Form I-9 as described above and retain it with the employee’s original Form I-9.

Automatic Extensions by Individual Notice

DHS may extend the EAD expiration date for some or all TPS beneficiaries of a certain country by issuing an individual notice that contains the new EAD expiration date. Check the USCIS TPS webpage for the latest information on TPS countries whose beneficiaries may have been issued individual notices.

New employees who are TPS beneficiaries may present the individual notice, along with their EAD with a Category Code of A12 or C19, to complete Form I-9. Employers should ensure the employee’s name and A-Number or USCIS Number on the EAD matches the name and A-Number or USCIS Number, provided in the individual notice.

How to Complete Form I-9 for EADs Extended by Individual Notices

In Section 1, new employees presenting an EAD automatically extended by an individual notice must:

- Select “A noncitizen authorized to work until;” and

- Enter the EAD automatic extension date provided in the individual notice as the expiration date.

In Section 2, in the List A column, the employer must:

- Enter EAD in the Document Title field.

- Enter the document number from the EAD with Category A12 or C19, as applicable.

- Enter the automatic extension date provided in the individual notice as the document expiration date.

For a current employee whose EAD has been automatically extended by individual notice, you must provide updated information on Form I-9. You should enter “EAD EXT” and the EAD automatic extension date from the individual notice in the Additional Information field in Section 2. For example, EAD EXT mm/dd/yyyy. Note that if the employee’s original Form I-9 was completed on a Form I-9 version that is no longer valid, enter “EAD EXT” and the new expiration date in the Additional Information field in Section 2 of the latest version of Form I-9 and retain it with the employee’s original Form I-9.

Reverification

You must reverify employees’ employment authorization when their automatic extension ends, and no later than the date their employment authorization expires. You can reverify temporary employment authorization before the automatic extension ends if an employee presents any unexpired document that shows employment authorization, such as any acceptable document from List A or C.

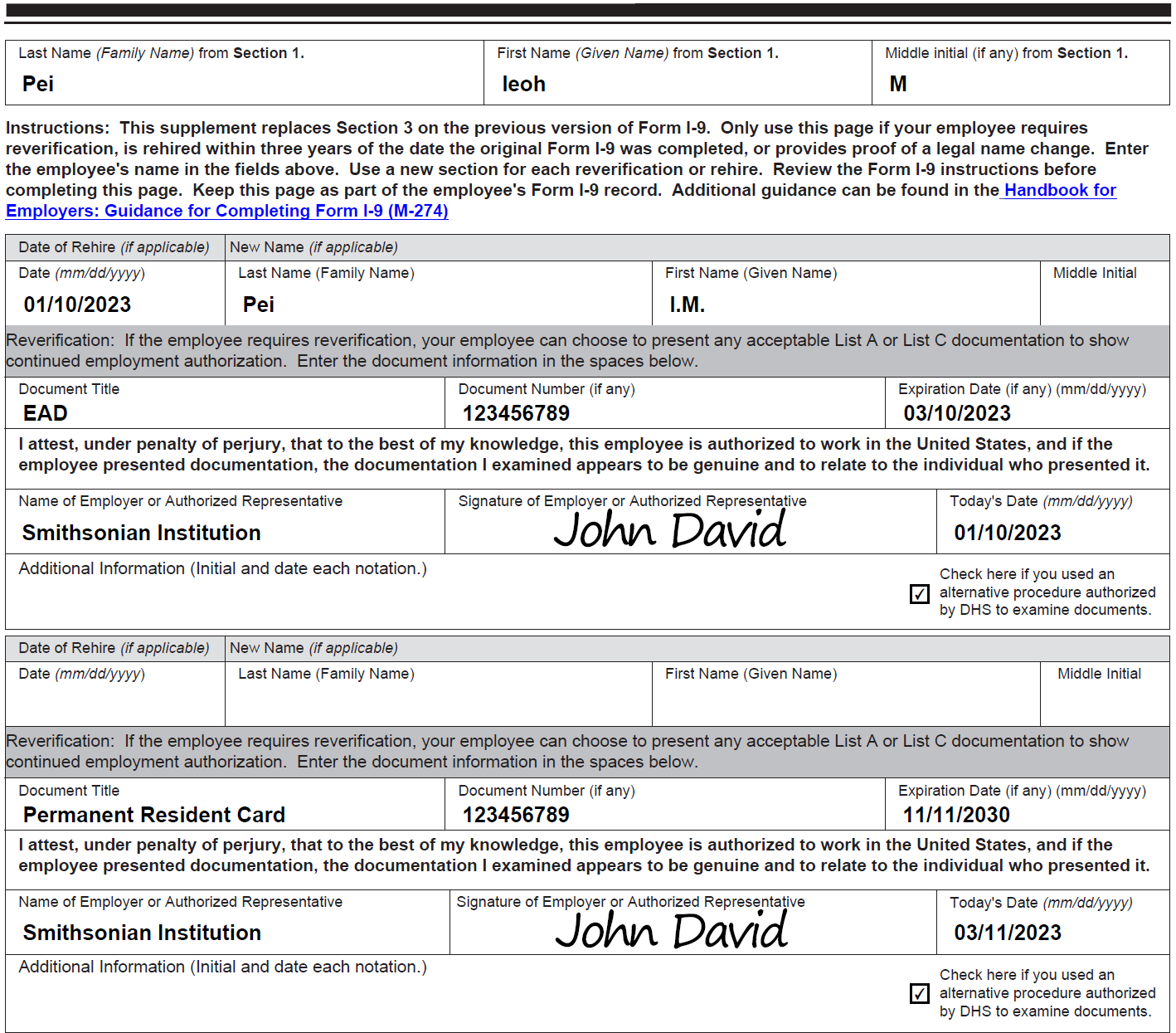

6.0 Completing Supplement B, Reverification and Rehire of Form I-9

Reverification is never required for U.S. citizens or noncitizen nationals. Reverification is also never required when the following documents expire: U.S. passports, U.S. passport cards, Permanent Resident Cards (also known as Green Cards), and List B documents. Other noncitizens may require reverification

6.1 Reverifying Employment Authorization for Current Employees

You must reverify an employee’s employment authorization no later than the date employment authorization expires. The employee must present a document that shows current employment authorization, such as any documentation from List A or C, including an unrestricted Social Security card. You must reject a restricted Social Security card and ask the employee to provide a different document from List A or C. You can also accept certain receipts for reverification; see the Acceptable Receipts table in Section 4.4, Acceptable Receipts, for more information. You cannot continue employing a person who does not provide proof of current employment authorization.

When you must reverify an employee, you will complete one block of Supplement B, Reverification and Rehire (formerly Section 3) and attach it to the employee’s original Form I-9. You may use additional blocks on this supplement for subsequent reverifications or updates, attaching additional supplement sheets as needed. If the employee’s previous update or reverification was completed on a Form I-9 version that is no longer valid, you must also complete Supplement B, Reverification and Rehire and attach it to the employee’s original Form I-9. Please check uscis.gov/i-9 for the current Form I-9.

To reverify your employee using Supplement B, Reverification and Rehire:

- Enter the employee’s full name from the original Form I-9 at the top of the supplement.

- If the employee’s name has changed, enter the new name in the appropriate New Name fields in one block of the supplement. Enter only the part of the name that has changed. For example, for employees who changed only their last name, enter the last name in the Last Name field and leave the First Name and Middle initial fields blank.

- Enter the document title, number and expiration date in that block of the supplement.

- You must sign, date and enter your name in the appropriate fields in that block. Keep this supplement page with the original Form I-9.

Some employees may have entered N/A in the expiration date field in Section 1 if they are noncitizens whose employment authorization does not expire, such as asylees, refugees, or certain citizens of the Federated State of Micronesia, the Republic of the Marshall Islands, or Palau. Reverification does not apply for such individuals unless they choose to present evidence of employment authorization in Section 2 that contains an expiration date and requires reverification, such as Form I-766, Employment Authorization Document. Employees with expiring immigration status, employment authorization, or employment authorization documents should have the necessary application or petition filed well in advance to ensure they maintain continuous employment authorization and/or valid documents. USCIS provides employment authorization extensions under certain conditions. See Section 7.0, Evidence of Employment Authorization for Certain Categories, for more information.

6.2 Reverifying or Updating Employment Authorization for Rehired Employees

If you rehire employees within three years from the date you completed their previous Form I-9, you may complete a block on Supplement B, Reverification and Rehire, or you instead complete a new Form I-9.

Figure 9: Completing Supplement B, Reverification and Rehires

If completing a Supplement B block for a rehired employee, follow these guidelines:

- If they are still authorized to work, they do not need to provide any additional documents. This includes U.S. citizens, noncitizen nationals, and lawful permanent residents who presented a Form I-551. For these employees, you must:

- Enter the employee’s full name from the original Form I-9 at the top of the supplement. Enter any name change in the New Name fields. Enter only the part of the name that has changed. For example, for employees who changed only their last name, enter the last name in the Last Name field and leave the First Name and Middle Initial fields blank.

- Enter their rehire date in the Date of Rehire field.

- Enter your name and sign and date the supplement block.

- If their employment authorization has expired, you must:

- Enter the employee’s full name from the original Form I-9 at the top of the supplement.

- Enter any name change in the New Name fields.

- Enter the rehire date in the Date of Rehire field.

- Reverify their employment authorization in the Expiration Date fields.

- Enter your name and sign and date the supplement block.

- If the previous Form I-9 is an old version of the form, you must complete a new block in Supplement B on the current version of the form. Please check uscis.gov/i-9 for the current Form I-9.

- If you already used a block in Supplement B of the employee’s previous Form I-9, but are rehiring them within three years of the date the original Form I-9 was completed, complete a subsequent block on the supplement. Employees rehired three years after you originally completed their Form I-9 must complete a new Form I-9.

- Enter the employee’s new name, if applicable.

- Enter the employee’s date of rehire, if applicable

- Enter the List A or C document title, number, and expiration date (if any)

- Sign and date the block of the supplement you completed.

Note: If you need to reverify the employment authorization of an existing employee who completed an earlier version of Form I-9, the employee may choose any List A or C document(s) from the Lists of Acceptable Documents for the most current version of Form I-9. Enter the information from the new document(s) in Supplement B, Reverification and Rehire of the current version of Form I-9 and keep it with the previously completed Form I-9. Visit uscis.gov/i-9 for the most current version of Form I-9.

6.3 Recording Changes of Name and Other Identity Information for Current Employees

During reverification or rehire, if an employee has had a legal name change (such as by getting married), you must enter their new legal name in the New Name fields of a block of Supplement B, Reverification and Rehire, as described in Sections 6.1 and 6.2. If they legally changed their name at any other time, we recommend you update the New Name fields in a subsequent block on the original supplement page or a new supplement page as needed, as soon as you learn of the change, so that you maintain correct information on the form.

To enter a legal name change in Supplement B, Reverification and Rehire without reverification or rehire:

- Enter the employee’s new name in the New Name fields.

- Enter your name and sign and date the block you completed on Supplement B, Reverification and Rehire.

In either situation, you should take steps to ensure the employee’s name change is accurate. This may include asking them to provide legal documentation showing the name change, such as a marriage certificate. Make a copy of that document to keep with Form I-9 in the event of an inspection.

You may encounter situations other than a legal name change where an employee informs you (or you have reason to believe) that their identity is different from what they used to complete their Form I-9. For example, an employee may have been working under a false identity, has subsequently obtained work authorization in their true identity, and wishes to regularize their employment records. In that case, you should complete a new Form I-9. Write the original hire date in Section 2 and attach the new Form I-9 to the previously completed Form I-9 and include a written explanation.